Table of Contents

Adelfi Auto Loan Work for You When it comes to securing an auto loan, it’s important to find terms that meet your needs and budget. Adelfi Auto Loan understands this, which is why they offer flexible options to match your financial situation.

Auto Loan Rates

Adelfi Auto Loan offers competitive auto loan current rates that can help you get behind the wheel of your dream car. Whether you’re in the market for a new car or a used one, Adelfi has you covered with loan programs. With their affordable interest rates, you can save money over the life of your loan.

Easy Application Process

Applying for an auto loan with current Adelfi is quick and easy. Their user-friendly online banking application (loan documents) allows you to apply from the comfort of your own home. All you need to do is provide some basic information about yourself, your income, and the car you are interested in purchasing no additional documentation require. Adelfi understands that your time is valuable, so they strive to provide a hassle-free application process. Also provide information through email address when you submit online loan application. Once you have submitted your online loan application to Adelfi Auto Loan, they will carefully review your information and get back to you in a timely manner with email confirming in 1 to 2 business days. One of their experienced loan officers will assess your application and work with you to find the best loan program that suits your needs like personal loan and student loan.

Flexible Repayment Options

Adelfi Auto Loan understands that everyone’s financial situation is unique. That’s why they offer flexible repayment options to fit your budget. With a variety of repayment terms available, you can choose the option that works best for you like via wire transfer. Whether you prefer a shorter term with higher monthly payments or a longer term with lower monthly payments, Adelfi has options to suit your needs.

Pre-Approval Process

One of the great advantages of working with Adelfi Auto Loan is their pre-approval process. By getting pre-approved for a loan, you can shop for your dream car with confidence. With a pre-approval in hand, you’ll know exactly how much you can afford and be able to negotiate the best price for your vehicle. Adelfi’s pre-approval process is quick and easy, with single application for max loan amounts.

AdelFi Auto Loan FAQs

Adelfi Auto Loan understands that potential customers may have questions about their pre-approval process and other aspects of their auto loan services. To provide clarity, here are some frequently asked questions: Here are some frequently asked questions about Adelfi Auto Loan’s pre-approval process and other aspects of their auto loan services:

making it convenient for customers to get the financing they need in a timely manner.

How do I apply for a pre-approval with Adelfi Auto Loan?

To apply for a pre-approval with Adelfi Auto Loan, you can simply visit their website and fill out their online application form. The form typically asks for basic information such as your name, contact details, income, and employment information. Once you submit the application, the Adelfi team (loan specialist) will review your information and provide you with a pre-approval decision with email notification.

How long does the pre-approval process take?

At Adelfi Auto Loan, they understand that time is of the essence when it comes to purchasing a vehicle. That’s why their pre-approval process is designed to be quick and efficient. In most cases, you can expect to receive a decision within a matter of hours or even minutes. This allows you to move forward with confidence and start shopping for your dream car as soon as possible.

How much can I get pre-approved for?

The amount you can get pre-approved for with Adelfi Auto Loan depends on several factors, including your credit history, income, and the price of the vehicle you are interested in purchasing. To get more info join portal for communication.

Featured Products

Auto Loan offers a wide range of featured products to suit your specific needs and preferences. Whether you’re looking for a new or used car, truck, or SUV, Adelfi has options for you. Here are some of their featured products: i Auto Loan understands that every individual’s financial situation is unique. That’s why they offer a wide range of featured products to cater to different needs and preferences. Whether you’re in the market for a brand-new car, a reliable used vehicle, or a spacious SUV for your growing family, Adelfi has options for you.

You get our membership with membership account application in membership portion, there is no high fee for membership only one-time $5 membership fee. There is membership packages 12-36 months, 36-60 months, 61-72 months and 73-84 months.

User Guides

Auto Loan understands that the loan approval process can sometimes be confusing for borrowers. To help you navigate through the process, they provide user guides that explain the steps involved in getting an auto loan with Adelfi. No auto loan statement require, no require loan papers, no loan qualification.

How to pay auto loan on AdelFi?

Adelfi Auto Loan makes it easy for borrowers to make their loan payments. They offer various payment options to suit your convenience. Here is a step-by-step guide on how to pay your auto loan on Adelfi.

- Online Payments: Adelfi provides an online platform where you can make your loan payments securely and conveniently. To make an online payment, you will need to log in to your Adelfi account. From there, you can navigate to the payment section and enter the necessary payment details. You can choose to make a one-time payment or set up automatic recurring payments for added convenience to transfer funds. AdelFide dealer via wire transfers money and wait for confirmation of wire transfers.

- Mobile App: Adelfi also has a user-friendly mobile app AdelFi Credit Union that allows you to manage your loan and make payments on the go. Simply download the mobile banking app from the App Store or Google Play, log in to your account, and navigate to the payment section for best digital banking solution use safe banking experience. You can follow the prompts to make your payment using a debit card, credit card, wallet & apple pay or banking account. Mobile app provide digital security for security measure in AdelFi deposit.

- Phone Payments: If you prefer making payments over the mobile device (android devices), Adelfi offers a dedicated customer service line where you can speak with a representative and make your payment. Simply call their customer service number and provide the necessary account and payment information for mobile deposits.

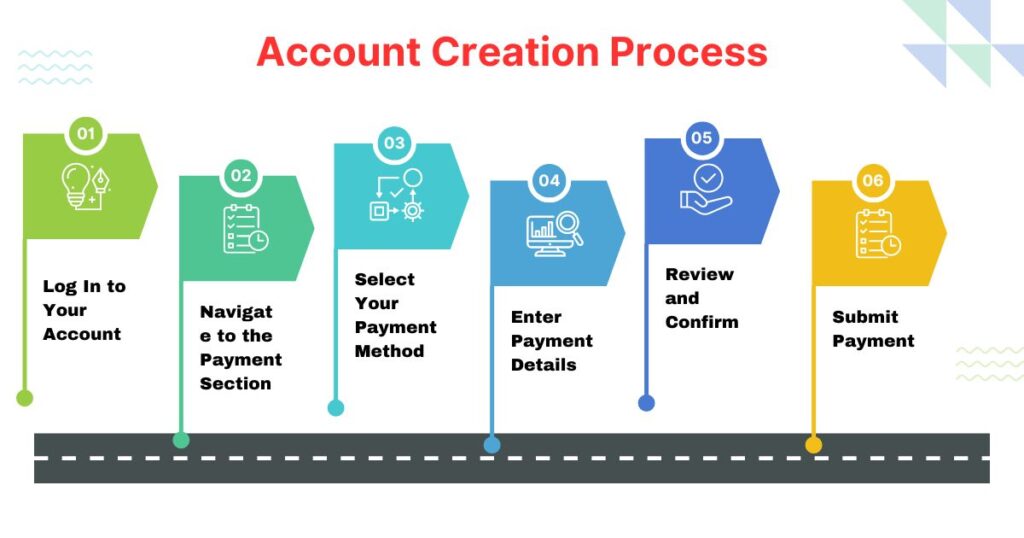

Account Creation Process

- Register for an Account:

To access the payment options, you will need to create an account on the Adelfi Auto Loan website. This is a simple process that requires you to provide some basic information, such as your name, contact details, and loan account number. Manage all loan application and loan documentation for loan funding.

- Log In to Your Account:

Once you have registered, you can log in to your account using your username and password. This will give you access to the various features and services offered by Adelfi.

- Navigate to the Payment Section:

Once logged in, navigate to the payment section on the website. Adelfi provides a user-friendly interface that makes it easy to find the payment options. Look for a tab or link that says “Make a Payment” or something similar.

- Select Your Payment Method:

Adelfi gives you multiple payment options to choose from. You can make your payment using a debit card, credit card, or by setting up automatic drafts from your bank account. Choose the option that is most convenient for you.

- Enter Payment Details:

Depending on the payment method selected, you will need to provide the necessary payment details. This may include your card details or bank account information.

- Enter Payment Amount:

After providing your payment details, you will need to enter the amount you wish to pay. Adelfi will typically display your current outstanding balance for reference. Ensure that you enter the correct amount to avoid any payment discrepancies. This is your loan request for AdelFi finances loans.

- Review and Confirm:

Before finalizing your payment, take a moment to review all the entered information, including the payment method, payment details, and payment amount. Double-check for any errors or inaccuracies to ensure a smooth transaction.

- Submit Payment:

Once you have reviewed and confirmed all the payment details, click on the “Submit” or “Pay Now” button to process your payment. Adelfi’s system will securely transmit your payment information and complete the transaction.

- Confirmation and Receipt:

After successfully submitting your payment, you should receive a confirmation message or email from Adelfi. This is decision via email, this will serve as proof of payment and may include a receipt detailing the transaction. It’s a good practice to keep these records for future reference to documentation for membership in future.

- Automatic Payment Setup (Optional):

If you prefer the convenience of automatic payments, Adelfi allows you to set up recurring payments. This means that your monthly installments will be automatically deducted from your chosen payment method on the specified due dates.

Conclusion:

In conclusion, Adelfi Auto Loan offers a convenient and user-friendly platform for managing your loan payments. By following the steps outlined in this article, you can easily make your payments online without any hassle.